capital gains tax increase 2022

The gains that you make from the selling of your capital assets which you held for at least one year will be considered long-term gains and these can be taxed at anything from 0. However stock market gains may be reduced if taxpayers subject to lower withholding rates opt for.

What You Need To Know About Capital Gains Tax

Jeremy Hunt will set out tax rises and spending cuts totalling 60bn at the autumn statement under current plans including at least.

. The basic rule for calculating capital gains is the sales price minus the cost of selling less the. Currently rates vary from 10pc to 28pc depending on the type of asset and the income of the taxpayer. The capital gains tax rate is 0 15 or 20 on most assets held for longer than a year.

This means youll pay 30 in Capital Gains. President Biden recently announced his plan to double the long-term capital gains tax rate for those at the top from 20 to 40. CGT is expected to raise 15bn in 2022-23 or 15pc of all receipts.

For example California taxes capital gains like regular income with a top tax bracket of 133. Youll owe either 0 15 or 20 on gains from the sale of most assets or investments held for more than one year depending on your annual taxable income for more. Friday 04 November 2022 701 am Rise in capital gains tax on the cards as Chancellor Hunt scrambles to raise 50bn.

Chancellor Jeremy Hunt is considering increasing capital gains tax on the sale of assets such as shares and second properties. Long-term capital gains tax in the case of equities is 10 if the total gain in a financial year exceeds Rs 1 lakh. A major high-speed rail line in northern England is reportedly being reviewed and capital gains tax could rise as the prime minister tries to find 50 billion in savings and tax hikes.

When you include the 38 net investment. The top rate would be 288 when combined with a 38 surtax on net investment income. Basic rate taxpayers would also see bills increase from 18 to 20.

Capital Gains Tax Rate. One option on the table is an increase in the. A report by the Office of Tax Simplification in 2020 said that aligning CGT with income tax rates could theoretically raise 14bn but warned the real revenue generated would be lower because.

By Jackie Annett 1855 Sat Nov 5 2022. A long-term capital gain is the profit realized on the sale of a security held for more than one year. The two biggest tax-cutting Conservative Chancellors in British history both increased capital gains tax and for good.

Currently capital gains on securities pay a 28 personal income tax. According to the IRS the salary brackets for 2022 have. The new rate would apply to gains realized after Sep.

As with the 28 rate for collectibles if your ordinary tax rate is below 28 then. Capital gains taxes on assets held for a year or less correspond to ordinary income tax brackets. 14 October 2022.

At the state level your capital gains taxes due will depend on your particular state. Because the combined amount of 20300 is less than 37700 the basic rate band for the 2021 to 2022 tax year you pay Capital Gains Tax at 10. First published on Sun 6 Nov 2022 1326 EST.

However for any gain that is not exempt from tax a maximum capital gains tax rate of 28 applies. In 2022 it would kick in for. As I understand it CGT was reduced from marginal income tax rates 2040 to 1828 and indexation and taper relief were removed to simplify tax and the CGT rates.

If the two taxes had the same rates higher rate taxpayers would see CGT bills rise from 28 to 40. Currently long-term capital gains are in general taxed at 20. Unlike short-term capital gains tax brackets for long-term capital gains are 0 percent 15 percent and 20 percent.

Taxable Income Single Taxable Income Married Filing Separate Taxable Income Head of Household Taxable Income Married Filing Jointly 0.

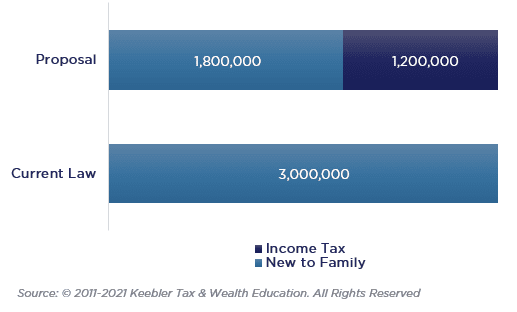

Eye On The Estate Tax Nottingham Advisors

Biden Capital Gains Tax Plan Capital Gain Rates Under Biden Tax Plan

Capital Gains Tax Rate In California 2022 Long Short Term Seeking Alpha

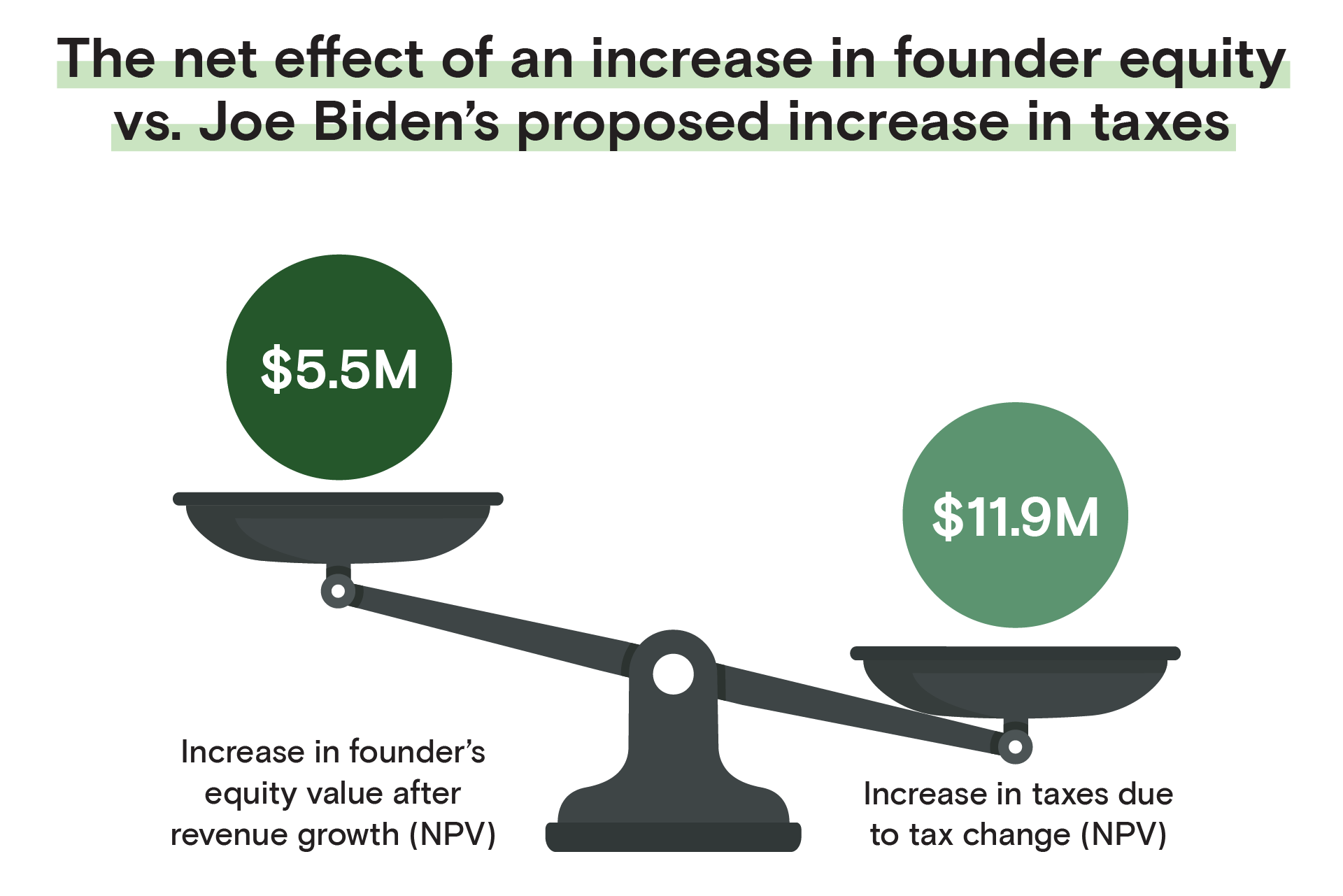

For Founders The Implications Of Joe Biden S Proposed Tax Code

Capital Gains Cuts Won T Cure The Covid 19 Economy Tax Policy Center

State Taxes On Capital Gains Center On Budget And Policy Priorities

Short Term Capital Gains Tax Rates For 2022 Smartasset

Rsu Taxes Explained 4 Tax Strategies For 2022

Summary Of Fy 2022 Tax Proposals By The Biden Administration

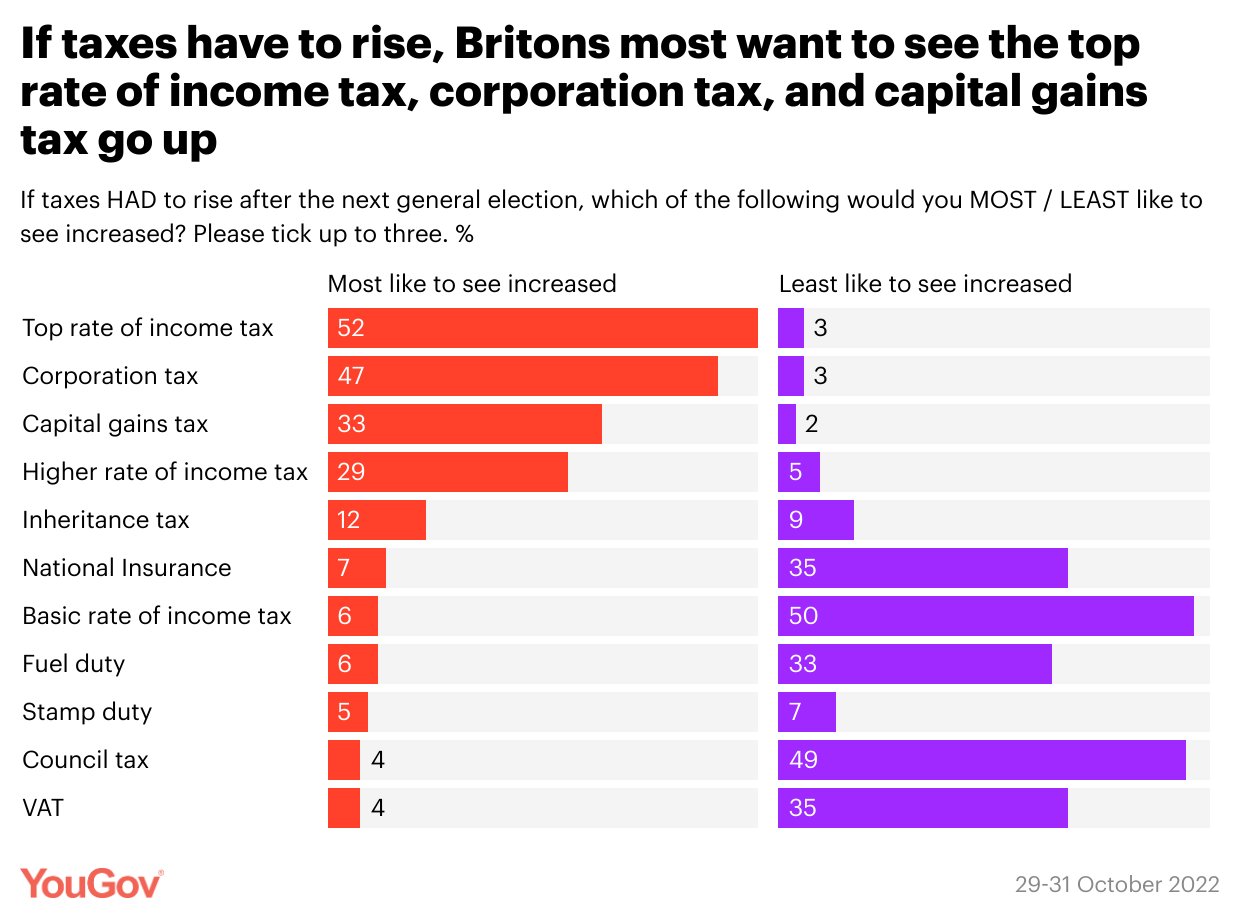

Yougov On Twitter The Govt Will Announce Tax Rises At The Autumn Statement If Taxes Have To Rise And Allowed To Pick Up To Three Britons Are Most Likely To Choose Top

Why Won T Canada Increase Taxes On Capital Gains Of The Wealthiest Families Fon Commentaries Vol 2 No 20 Finances Of The Nation

State Capital Gains Taxes Where Should You Sell Biglaw Investor

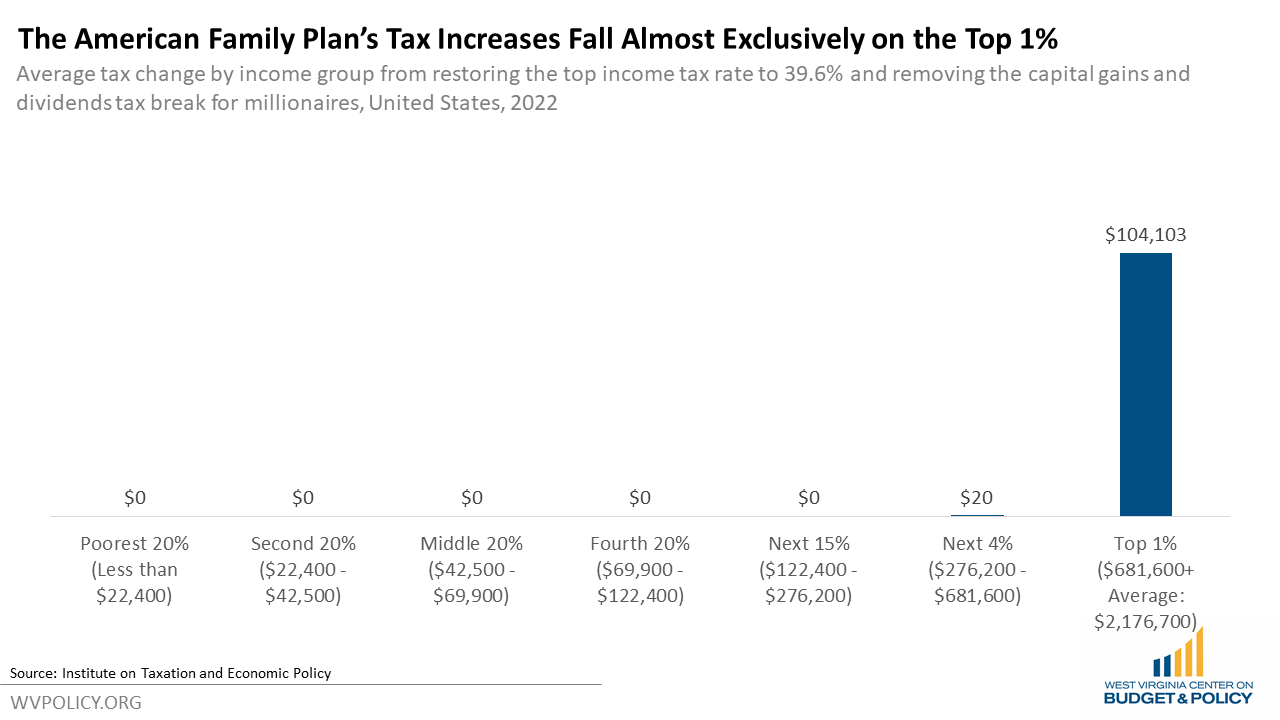

Proposed Tax Increases In The American Families Plan Would Affect Only 0 1 Percent Of West Virginians West Virginia Center On Budget Policy

Selling Stock How Capital Gains Are Taxed The Motley Fool

How To Avoid Capital Gains Tax With A Trust Arch Legacy Firm

Biden Administration Releases Green Book On Fy 2022 Tax Proposals Marcum Llp Accountants And Advisors

The Tax Impact Of The Long Term Capital Gains Bump Zone

President Obama S Capital Gains Tax Proposals Bad For The Economy And The Budget Tax Foundation